Under Insured Handyman

Bob is a happy and frugal income property owner. He has owner many properties for many years and he is well liked by his tenant, some of which have been with him for more than ten years. When discussing liability insurance with his favorite insurance guy he told him that he is not worried about his tenant suing him because he takes very good care of them. So, he selected $300,000 per occurrence limit for his liability insurance. He saved $60 a year from buying a $1,000,000 limit.

Bob also looks for ways to save while maintaining his income properties well. He hires his good friend Sal to do the work on the properties since they have been happily working together for years. A couple of years ago, primarily because of nagging from his favorite insurance guy, he inquired of Sal if he has contractorís insurance. Sal said no and reluctantly went and purchased some.

Sal, the contractor, purchased a step up from the minimum insurance of $50,000 that was available to twice that much! Yes, Sal was now covered with $100,000 of insurance protection! This saved Sal about $430 a year off of the $1,000,000 policy the insurance agent suggested.

A year later Sal has occasion to do work on Bobís four family house. He does some drywall work on this older home getting an apartment ready for the new tenants, a single mom and two children. He could find any regular drywall screws in his pouch while he was working but he did find longer deck screws. They work just as well and nicely, they are easier to drive. While zipping in the last screw, POP, the lights and the power went out in that room. After making the appropriate statement of surprise and dismay backed the screw out a bit and test the circuit breaker. It the lights and power came back on, no problem. Sal finished the wall and three days later the fresh tenants moved in.

Over two months has now passed. The power went off in the room in question. Bob, who was unaware of what Sal had done, went to the building, flipped the breaker back on while the one of the tenantís daughterís was watching, and when they checked to roomís lights and outlets all was fine. Speaking with mom and the daughter he questions what all was hooked up to the outlets that would have made the power go out. Nothing was the answer.

Two days later daughter has a party while mom is out. The power goes out again. Daughter saves the day and face with her friends when she alone turns the power back on.

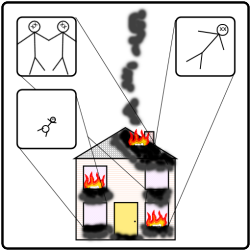

That night the building nearly burns down with fatalities.

The cause is found to be a short in the wall that Sal had put new drywall up on. The cause is suggested to be an arc between the long screw and the wires.

Sal and Bob both quickly learn how fast liability insurance can be exhausted. They also learned, albeit too late, that liability insurance is designed not only to protect the insured, but also to protect the injured. The building was lost because of Salís error, Replacement Cost about $300,000. Every tenantís personal possessions were lost, averaging $30,000 per each tenant. Total tenants stuff losses $120,000. The elderly man that died, the insurance company settled with his adult daughter for an undisclosed amount. Litigation is ongoing over the death a baby in the neighboring apartment.

We have no additional information about this case because after Bobís Landlordís policy sued Sal for the value of the building his policy ran out of money. Salís policy had no money left so when the families of the deceased sued Sal and found that he had no money they also sued Bob because he hired Sal. When insurance companies spend all of the money they have allotted under liability coverage even in the cost of making a defense they now step away from the claim. They no longer have any duty to the insured. Now both Bob and Sal are dealing with lawsuits with no help from insurance companies.

What could have been done differently?

Sal should have purchased at least $1,000,000 of liability coverage that he could have acquired easily. He should have taken the drywall down and repaired the wires, used shorter screws, and a separate circuit should have been run taking the lights off of the outlet circuit, and he should have notified Bob of all concerns in writing.

Bob should have purchased at least $1,000,000 of liability coverage per occurrence.nbsp; He should have required Sal have at least $1,000,000 of liability insurance per occurrence listing Bob as additional insured. He should have required that Sal notify him of any life safety or maintenance issues he discovers in the course of his work.

There are several other issued that should also be addressed. By now you get the idea, ďDonít cheap out on your coverage!Ē

How much is enough insurance?

How much insurance should you as a property owner require your contractor to have?

Letís do the math.

$300,000 Ė Four Family House

$120,000 Ė Tenants Possessions

$500,000 Ė Serious Life Long Injury

$X,000,000 Ė The Value of a LifeDoes it any sense for you to allow your contractor have less than $1,000,000 of per occurrence liability coverage? We think that answer is no. What do you think?

Find more landlord insurance information here.

To learn more, contact us at 607 843 8860 or insurance@drickardinsurance.com.